Joondalup Office:

Unit 1 - 89 Winton Rd,

Joondalup, WA, 6027

(08) 9256 3788

info@cwmm.com.au

Accumulating Your Wealth

Case in point: Paying just $200 more monthly towards your home loan.

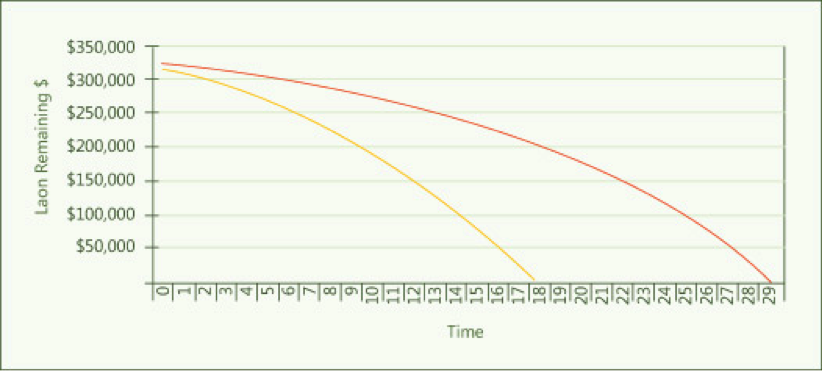

The average home loan in Australia was $357,000 in February 2016 according to the Australian Bureau of Statistics. Over a 30 year term at a 4.00% fixed interest rate, you will pay more than $254,000 interest.

By contributing an extra $200 monthly you’ll save over $52,000 in interest paying the loan off 5 years sooner! The $52,000 you saved can be utilized for further investing.

Start Early!

World renowned investor Warren Buffet bought his first stocks at age eleven. And he says he started too late!

If you’re a Gen X or early Gen Y, aged between 30 – 45, you may think that investing via traditional wealth management is not suitable for you. Right now you are probably at the earnings peak of your life, and therefore should have the capacity for investing.

Cedar Wealth looks at things differently. Our comprehensive wealth management model assists with financial challenges facing younger generations.

These challenges include personal cash flow, managing debt, repaying mortgages and understanding how good wealth management funds lifestyle, home purchases, school fees, holidays and early retirement!

Cedar Wealth uses unique wealth management systems integrating all aspects of your financial situation ensuring seamless operation. From managing tax affairs correctly through to share investing, we can help.

Our Wealth Management Model assists you:

- Implement a personalised plan to get your money working for you sooner.

- Reduce bad debt and repay your mortgage faster, creating equity for investing.

- Increase after tax income to free up cash for investing.

- Increase your wealth by leveraging your existing income and assets.

- Protect the most important things – family, income and assets.

- Realise the full benefits of Super through consolidation and investing the money effectively.

Take Action & Contact Us Now or call us on (08) 9256 3788 to book your consultation.