Joondalup Office:

Unit 1 - 89 Winton Rd,

Joondalup, WA, 6027

(08) 9256 3788

info@cwmm.com.au

Options For Retirement Planning

Self-Managed Superannuation (SMSF)

Self-Managed Super (SMSF) is a very useful tool for business owners (and individuals) wanting more control over their investments.

As an estate planing tool, SMSF’s can be used very effectively to deal with the very complex areas of tax planning after a member passes away.

If you are a business owner, you also have the option of owing your business premises inside your SMSF, giving you options to increase the balance by renting your business premises directly from the fund.

Another advantage of holding property inside an SMSF is the Capital Gains Tax planning that is available under current legislation.

Whatever your need, seek advice in this area.

Contact us if you would like to have a discussion about whether it works for your situation.

Individual Retirement Optimiser

Australians are retiring earlier and living longer.

It’s critically important to start planning the time when you want to retire and enjoy the fruits of your labour.

Retirement means different things to different people; this is why we believe that saving for retirement doesn’t need to be scary!

Find out here what you can do with your super!

Cedar Wealth’s Retirement Optimiser can help you to:

- ensure you make the most of your remaining years at work

- accelerate your savings

- either retire earlier or

- enjoy a more comfortable lifestyle after work.

If you want to see how our Retirement Optimiser can help save you valuable dollars in tax, while rapidly enhancing your retirement savings, call us today to book your initial consultation.

In short, our Retirement Optimiser could help you:

- Decide when you may be able to reduce your working hours or begin retirement.

- Determine how much income you need in retirement and how you can achieve this.

- Significantly enhance your final superannuation balance during the last 5 – 10 years prior to your retirement.

- Save you valuable money in tax which can be used to accelerate your retirement Wealth Creation.

- Get the confidence you need to achieve your lifestyle goals in retirement.

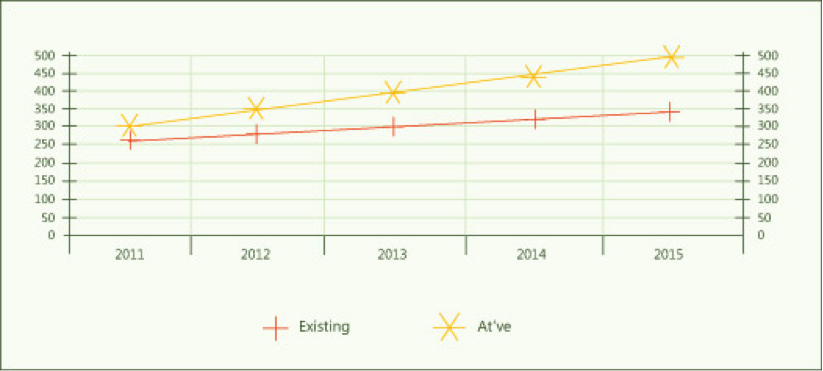

Case in point: Implementing a Retirement Optimiser Plan

Joe, aged 60, earning $75,000 p.a. and paying $16,050 per year in tax during the last 5 years of his working life, had a starting super balance of $250,000. After consulting with his adviser at Cedar Wealth and using our retirement optimiser strategy he ends up enhancing his retirement superannuation by over $145,000 and paid on average $7,000 p.a. less in tax during his last 5 years working.

Call us on (08) 9256 3788 for your complimentary consultation.

Alternatively you can Contact Us For More Information and we’ll be in touch to set an appointment time that is convenient to you.